Mortgage Rates Today: what's actually happening

Mortgage Rate Rollercoaster: Buckle Up, Buttercups

Another Day, Another Pointless Fluctuation

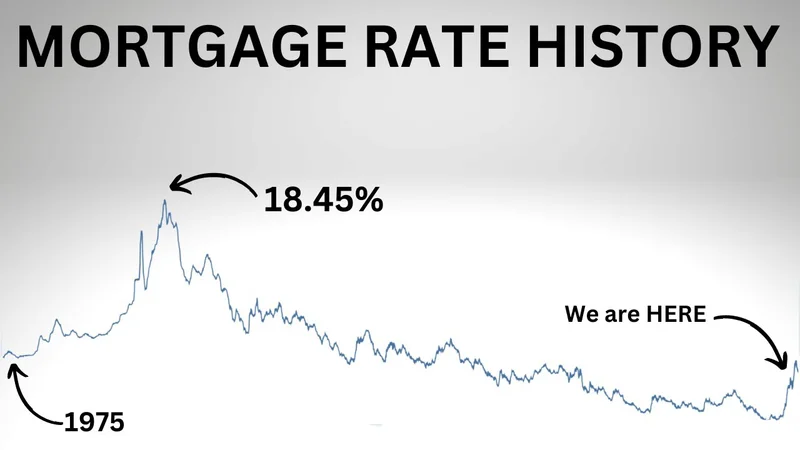

So, mortgage rates are up again. 6.09% APR, Mortgage Rates Today, Tuesday, November 25: Kind of a Big Jump - NerdWallet says. Whoop-dee-doo. Like anyone can actually afford a house these days anyway. It's up 14 basis points from yesterday, down 13 from last week. Honestly, does anyone even understand what a "basis point" is? It sounds like something you get fined for in baseball.

This whole thing feels like Kabuki theater. Investors "believe" a rate cut is likely? Oh, they believe it? Well, that settles it then. Let's all just base our major life decisions on what some suit on Wall Street believes.

And "volatility is still present day to day." You don't say! Thanks for that earth-shattering insight. It's like saying the sky is blue. Obvious, useless information.

Refinance? Only If You're an Idiot...Or Rich

Oh, and here's the kicker: Refinancing "might" make sense if rates are 0.5 to 0.75 of a percentage point lower than your current rate. Might? Might?! Let's be real, if you're even thinking about refinancing, you're probably already drowning in debt and grasping at straws. And who has the cash to cover closing costs these days?

I swear, these "financial experts" live on another planet. They sit in their ivory towers, sipping lattes, and telling us plebs to just refinance our way to financial freedom. As if.

Speaking of planet's... I'm still annoyed that the coffee shop near me charges extra for oat milk. It's oats! Oats are cheap!

The "Customized Rate" Scam

And then there's the classic bait-and-switch: "The rate you see advertised is a sample rate." Translation: The rate you see is a complete lie. It's only for people with perfect credit, a giant down payment, and who are willing to sell their soul for "mortgage points."

Your actual rate? Well, that depends on everything from your credit score to the phase of the moon. Debt-to-income ratio? Employment history? Location? Property type? Loan amount? Give me a break. It's designed to be confusing, opaque, and ultimately, to screw you over.

But wait...are we really supposed to believe these mortgage companies are being honest about any of this?

A rate lock protects you from increases, but a "float-down option" lets you take advantage of a better rate. Sounds great in theory, but I'm betting there's fine print longer than the Bible to make sure they still win in the end.

So, What's the Point of All This?

The point is, the whole system is rigged. It's a game designed for the house to win, and we're all just pawns in their little game of financial manipulation. The housing market is a joke, and these fluctuating mortgage rates are just adding insult to injury. I ain't buying it.

Tags: mortgage rates today

Alphabet Stock Price: Is Google's 'Rally' Just Smoke & Mirrors?

Next PostExperian Redefines Credit Scoring: The Breakthrough Impact on Your Financial Future

Related Articles