DeFi's 2025 'Recovery': Still a Mess. (- Deep Dive)

DeFi's "Safer" Bet? Don't Make Me Laugh

"Investors seem to be opting for safer names..." Oh, really? Safer how? Like putting your money under a mattress instead of lighting it on fire? Because let's be real, in the crypto world, "safe" is a relative term. It's like saying a slightly less rusty knife is "safe" to juggle. You're still gonna get cut.

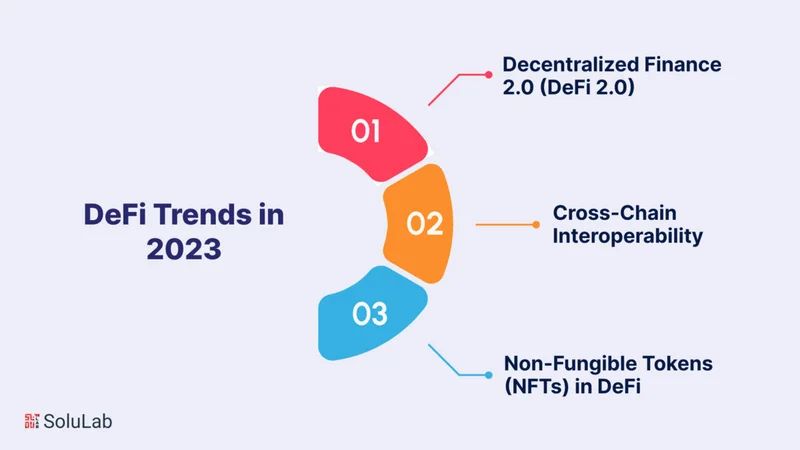

This whole idea that people are flocking to "buyback" names or those with "fundamental catalysts" is corporate-speak for "we're trying to prop up failing projects with buzzwords." HYPE and CAKE, posting "some of the best returns"? Please. That's like saying a band-aid is "some of the best treatment" for a gunshot wound. Sure, it's something, but it ain't gonna fix the underlying problem. What problem? That DeFi, in general, is a house of cards built on hype and hopes. As one report indicates, investors are shifting strategies in the wake of recent market events, seeking perceived safety in specific DeFi tokens DeFi Token Performance & Investor Trends Post-October Crash.

And these "idiosyncratic catalysts" for MORPHO and SYRUP? Minimal impact from a collapse or "seeing growth elsewhere"? That's called dumb luck, folks. Not a solid investment strategy. It's like saying you won the lottery because you wore your lucky socks.

So, what's the takeaway here? Investors are running scared. They see the October crash still echoing, and they're desperately clinging to anything that looks remotely stable. But let’s be honest; stability in DeFi is an illusion. It's a mirage in the desert, promising water but delivering only sand.

Lending's "Stickier" Appeal? More Like Desperation

"Lending and yield-related activity is often seen as stickier than trading activity in a downturn." Stickier, huh? More like desperate. People are piling into lending because they're too scared to trade. They're hoping to squeeze out a few extra pennies while the whole market teeters on the brink of collapse. And these fees are declining 34%...offcourse that makes it even more appealing, right?

It's like everyone's suddenly become a banker, except instead of lending out actual money, they're lending out magic internet beans to strangers they've never met. And they think this is safer? Give me a break.

The article suggests lending activity might pick up as people exit to stablecoins seeking yield. Okay, so you're exiting volatile assets to enter...stablecoins? Which are, let's not forget, often backed by...wait for it...volatile assets! It's turtles all the way down, people. This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire.

I’m starting to feel like that one dude at the party who keeps yelling, “Don't drink the punch!” and everyone just ignores him. You know what? Maybe I'm wrong. Maybe DeFi is the future. Maybe I'm just too cynical to see the genius. But I doubt it.

Prediction Markets: The Only Honest Game in Town?

The article mentions that "the only crypto trading category seeing record volumes lately are prediction markets." Well, isn't that just perfect? The only thing people are making money on is betting on how screwed up everything else is going to get. It's like the financial world's version of watching a train wreck in slow motion.

It’s like we’re all characters in some dystopian novel where the only growth industry is predicting the apocalypse. And honestly, I’m not sure if that's a sign of ingenuity or just a symptom of terminal decline.

Maybe I should start my own prediction market. I'd call it "How Screwed Is the Crypto Market?" And the payout? More crypto, of course. I’m getting myself all worked up now; I should probably go make a sandwich or something...

Bitcoin 2023: The Unseen Force Driving Its Surge - Twitter in Shambles

Next PostCrypto Market: They're Rigging the Game.

Related Articles