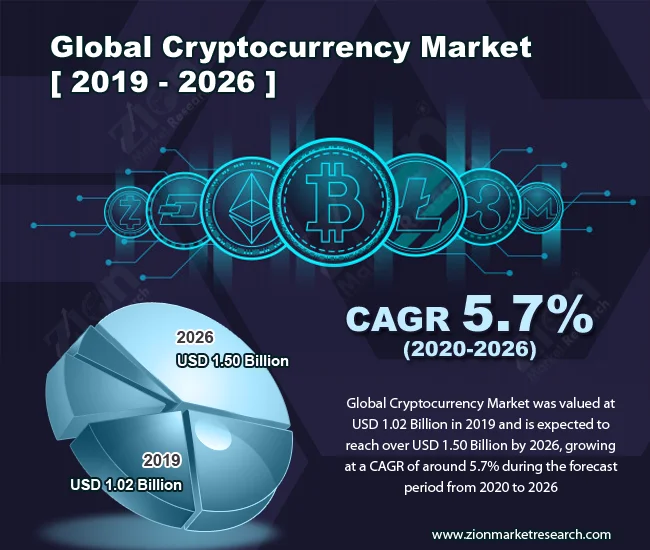

Crypto Market: They're Rigging the Game.

Generated Title: Crypto's Regulatory "Clarity" in 2025? More Like a Cloudy Mess

Alright, let's be real. "Regulatory clarity" in crypto? That's what they're calling it? Give me a freaking break. All I see is a bunch of politicians and bureaucrats scrambling to figure out what the hell a blockchain even is, while simultaneously trying to tax it into oblivion.

Stablecoins: The New Shiny Toy

So, apparently stablecoins were the "huge focus" for policymakers in 2025. Over 70% of jurisdictions supposedly "progressing" stablecoin regulation. Progressing? More like spinning their wheels. They think they can regulate something that's designed to be, you know, decentralized? It's like trying to herd cats with a laser pointer.

The GENIUS Act: A Closer Look

And the GENIUS Act in the US? Don't even get me started. They slap a fancy name on it, and suddenly everyone's supposed to think it's some monumental achievement. It's just another way for the government to stick its nose where it doesn't belong. I'm sure the lobbyists are thrilled, though.

Institutional Adoption: A Cynical View

I saw this line, "stablecoins became the entry point for institutional adoption." Translation: big banks and hedge funds finally figured out how to game the system and make a quick buck off crypto without actually understanding any of the underlying technology. Color me shocked.

Institutional Adoption: Hype or Reality?

Oh, and get this: "financial institutions in about 80% of our reviewed jurisdictions saw financial institutions announce digital asset initiatives." Announce. Announce. That's the key word here. It's all talk. Press releases and photo ops. How many of these "initiatives" actually went anywhere? How many are just vaporware designed to impress shareholders? I'm betting it's a whole lot of nothing.

Innovation-Friendly Regulation? A Skeptical Take

Here's a gem: "markets with clear, innovation-friendly regulation...became catalysts for global institutional participation." Innovation-friendly? Is that what we're calling it now? More like "regulation-friendly." The only innovation they care about is how to squeeze more fees out of every transaction.

Basel Committee's Reassessment: A Political Game

And the Basel Committee's "reassessment" of its proposed rules? They were gonna require "full capital deductions for most crypto assets." Then the US and UK balked, because offcourse they did. Now they're "softening" their stance. It's all a game of political chicken. Who's gonna blink first? Who's gonna get to control the narrative?

Regulatory Capture: The Real Innovation

You know what's not innovative? Regulatory capture.

Illicit Finance: The Boogeyman

Of course, they always bring up "illicit finance." It's the perfect boogeyman to justify any kind of overreach. "VASPs have significantly lower rates of illicit activity than the overall ecosystem." So what? That just means the criminals are moving to the unregulated parts of the market. It's like squeezing a balloon – you just push the air somewhere else.

North Korea's Hack: The Wild West Reality

And North Korea's "record-breaking hack on Bybit"? A billion and a half dollars in Ethereum tokens? That's a lot of freaking money. But let's be honest, that kind of thing was gonna happen eventually. It's the Wild West out there, and the regulators are just sheriffs with water pistols.

A Need for New Boots: A Metaphorical Aside

Speaking of the Wild West, I need a new pair of boots. The old ones are starting to fall apart, just like this whole regulatory charade. I saw a pair at that store on Main Street, but they're probably overpriced...

Conclusion Title: The More Things Change...

So, the US is "signaling its intent to lead globally." That's what they always say. Lead where? Into another financial crisis? Into a surveillance state where every transaction is tracked and monitored? I'm not buying it.

It's the same old song and dance. Politicians making promises they can't keep. Regulators playing catch-up with technology they don't understand. And the average Joe gets screwed in the process.

DeFi's 2025 'Recovery': Still a Mess. (- Deep Dive)

Next PostThis is the latest post.

Related Articles