Alright, let’s talk about Jupiter (JUP). Not the planet, the Solana-based DEX aggregator. The price predictions are, frankly, a mess. You’ve got some analysts saying it'll barely budge, others claiming it's going to the moon—or at least 10x from here. What’s a data-driven investor supposed to do with that? Time to cut through the noise.

Jupiter: Hype Train or Solana's Liquidity King?

Jupiter (JUP): An Overview

First, the basics. JUP aggregates liquidity across Solana's decentralized exchanges. It's supposed to find you the best price for your token swaps. Launched in January 2024, and it had a wild start. IDO at $0.55, then a quick spike to $2 (volume near $400 million!), followed by a 75% crash within 24 hours. Hype, meet reality.

Rollercoaster Ride: Trading History and Price Action

Price Action and Trading History

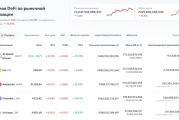

Since then, it's been a rollercoaster. A recovery in Q1 2024, a downtrend in Q2, stabilization attempts in Q3. As of mid-November 2025, we're looking at a trading range of roughly $0.35–$0.4, with daily volumes bouncing between $40 and $70 million. Not exactly confidence-inspiring.

Forecast Follies: Spotting the Crypto Fantasies

Analyzing Price Predictions

Now, let’s look at those predictions. DigitalCoinPrice is relatively conservative, suggesting a maximum of $0.75 by the end of 2025. PricePrediction is slightly more optimistic, targeting $0.55. Telegaon, however, is off in fantasyland, projecting a peak of $5.29. That's a more than 14x increase from the current price. What accounts for this discrepancy? Methodological differences, sure, but also wildly different assumptions about the future of Solana and DeFi as a whole.

Solana's Growth Mirage: What Happens When the Music Stops?

The Problem with Growth-Dependent Models

Here's where I see the problem. (And this is the part of the report that I find genuinely puzzling.) Most of these predictions rely on *growth*. More users, more liquidity, more adoption. But what if that growth doesn't materialize? What if Solana hits a wall, or a new, shinier blockchain steals its thunder? These models don't seem to account for that downside risk.

Telegaon's $46 JUP: Wishful Thinking or Realistic Target?

Examining Telegaon's Ambitious Projections

Take Telegaon’s projections, for example. They foresee JUP hitting $46.25 by 2030. That requires not just growth, but *explosive* growth. It assumes Jupiter will become a dominant DEX aggregator, which isn't a given. There are plenty of competitors out there, and the DeFi landscape is constantly evolving.

Technical Analysis: No Bottom in Sight?

Technical Analysis Signals

And what about the technical analysis? Investing.com's monthly data paints a bearish picture. Most indicators point to "Strong Sell." Moving averages are consistently negative. The market seems to lack the strength for a sustained move upwards.

Jupiter: Hype vs. Hard Data

Jupiter's Strengths and Weaknesses

Now, I'm not saying Jupiter is doomed. It has some things going for it. It's a key part of the Solana ecosystem, and it offers some useful features, like MEV protection and DCA tools. But the price predictions I'm seeing are based on hope, not hard data. They're extrapolating from past performance without considering the potential for disruption or stagnation.

Prediction Methods: Gut Feelings or Data-Driven Insights?

Questioning Prediction Methodologies

Here's a thought leap: How are these predictions even *made*? Are they based on sophisticated models, or are they just gut feelings dressed up in fancy charts? I suspect it's a bit of both. And that's fine, as long as you understand the limitations.

Jupiter's $0.30 Floor: A Ray of Hope?

Support Levels and Buyer Interest

One thing I do give Jupiter credit for, is maintaining a somewhat consistent support zone between $0.3 and $0.45. That's something. It suggests there are at least some buyers willing to step in at those levels. But it's hardly a reason to bet the farm.

Jupiter (JUP): $0.85 or Just Hot Air?

Noone Wallet Analysis

The Noone Wallet Analysis Team, in late October 2025, projected that JUP could reach $0.85 by the end of 2025, from a reference price of $0.44. Their reasoning? Jupiter's role as a liquidity hub and its expanding product lineup. But they also cautioned about macro risks and protocol-level challenges. A balanced view, which is rare in this space.

Jupiter's Revenue vs. Token: A Disconnect or a Warning?

Blockworks' Perspective on Mispricing

Blockworks also highlighted the disconnect between Jupiter's strong fundamentals (Q3 2025 revenue of $45 million, an annualized run rate of $180 million) and its weak token performance (market cap dropping from $3 billion to $1.1 billion). They argued that this mispricing may offer upside. Maybe. But it also suggests that the market isn't convinced by those fundamentals.

JUP: Potential, Pitfalls, and Plenty of Hype

Conclusion: Proceed with Caution

So, where does that leave us? The JUP price predictions are all over the place, and the data doesn't offer a clear answer. The token has potential, but it also faces significant challenges. Approach with caution, and don't believe the hype.

Data Doesn't Justify the Hype