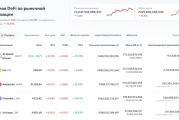

Alright, let's get one thing straight: if you're still clinging to the hope that DeFi is "the future," you're either delusional or you’re trying to sell me something. FalconX drops a report that basically says two out of 23 DeFi tokens are positive YTD? Give me a break. We're talking about a freakin' graveyard here.

DeFi's "Revolution"? More Like a Controlled Demolition.

The October Massacre and Its Aftermath

So, we had this "crash" back on October 10th. A crash is putting it mildly, more like a controlled demolition of everything we were told was going to revolutionize finance. And now? The DeFi sector is softer than week-old bread. Down 37% QTD on average? That's not a dip; that's a freakin' cliff dive. According to a recent analysis, the DeFi market is experiencing significant shifts in investor behavior following the October crash, with investors moving towards safer tokens

DeFi Token Performance & Investor Trends Post-October Crash | 2025 Analysis - News and Statistics - IndexBox.

Some DEXes – CRV, RUNE, CAKE – they're bragging about slightly better fees over 30 days compared to September. Okay, great. So a few guys are making slightly more money while the entire sector is collapsing around them. That's like celebrating that the band played on while the Titanic sank.

And then there's KMNO. Market cap down 13%, fees down 34%. I mean, at least they're consistent in their failure, I guess?

"Safer" Crypto: Like Juggling Knives That Are *Less* Rusty?

Flight to "Safety" – Or Just a Different Kind of Stupid?

The report says investors are running to "safer" tokens with buybacks or "fundamental catalysts." Oh, please. "Safer" in crypto is like saying a slightly less rusty knife is "safer" to juggle. It's all still ridiculously risky.

And get this: people are supposedly crowding into lending names because they think lending and yield stuff is "stickier" than trading. Are you kidding me? "Stickier"? As if people won't pull their money out of a lending platform the second they smell trouble? What kind of hopium are these people smoking? Maybe I'm the crazy one here.

Speaking of smoking things, my damn internet provider is throttling my connection AGAIN. I swear, I pay these guys a fortune and I can barely stream a cat video without buffering. It's like dealing with DeFi all over again – overhyped promises and zero delivery.

Spot and perpetual DEXs are seeing their price-to-sales multiples tank. Lending and yield names? Supposedly "steepening on a multiples basis." What does that even MEAN? It sounds like financial mumbo jumbo designed to confuse regular people into handing over their cash.

DeFi's "Cake" and "Syrup": A Recipe for Disaster?

But Wait, There's... Cake?

HYPE is down 16% QTD, CAKE is down 12%, MORPHO is down a measly 1%, SYRUP is down 13%. A mixed bag of garbage, really.

But let's be real here, we're talking about digital tokens named after freakin' CAKE and SYRUP. Are we supposed to take this seriously? This ain't a revolution; it's a pastry shop gone horribly wrong.

The real question is, who’s holding the bag? Who's going to be left holding these soon-to-be worthless tokens when the music stops? And more importantly, why do we keep falling for this crap?

This Whole Thing Stinks Worse Than Last Week's Sushi

I'm calling it. DeFi's not just having a bad quarter; it's circling the drain. The "future of finance"? More like a cautionary tale of hype, greed, and really bad tokenomics.