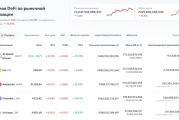

The crypto markets haven't exactly been a bastion of stability lately. Following the October 10, 2025, crash, the entire sector seems to be nursing a collective hangover, especially DeFi. The numbers paint a clear picture: as of November 20, only 2 out of 23 top DeFi tokens are showing positive YTD returns. QTD, we're looking at an average drop of 37%. Ouch.

Investors, naturally, are scrambling for anything that resembles safety. The buzz is all about "buyback" DeFi tokens and projects with "fundamental catalysts." The question is, are these truly safe havens, or are we just seeing a flight to perceived safety based on flimsy narratives?

DeFi's Diverging Paths: DEXs vs. Lending

DEXs vs. Lending: A Tale of Two Verticals

Let's break down the performance across different DeFi verticals. DEXs (Decentralized Exchanges), both spot and perpetual, are seeing declining Price-to-Sales (P/S) multiples. That's not entirely surprising given the overall market sentiment. However, some DEXs are bucking the trend. CRV, RUNE, and CAKE have actually posted greater 30-day fees as of November 20 compared to September 30, 2025. (A possible sign of life, or just a temporary blip?) On the other hand, HYPE and DYDX multiples are compressing faster than their fee generation is declining. This discrepancy suggests investors are losing faith in their long-term growth potential.

Now, let's turn to lending and yield platforms. Here, we see a different dynamic. Multiples are broadly steepening, but not in a good way. Prices have declined considerably *less* than the fees generated. Take KMNO as an example: its market cap fell 13%, while fees declined a whopping 34%. This indicates that investors are clinging to these tokens despite their deteriorating fundamentals. Are they hoping for a turnaround, or are they simply stuck in a losing position?

Bitcoin Bleeds, El Salvador Gambles, Hope Fades

ETF Outflows and El Salvador's Gamble

The broader market context isn't helping either. Spot Bitcoin ETFs saw $3.79 billion in net outflows in November (through November 21), the highest since February. And November 20 saw a single-day exodus of over $900 million. This suggests a loss of institutional confidence in Bitcoin, which inevitably spills over into the rest of the crypto market.

El Salvador, meanwhile, continues to double down on its Bitcoin bet. They bought another 1,090 BTC at around $90,000 each, bringing their total holdings to nearly 7,500 BTC. (A bold move, to say the least, considering the current price is substantially lower.) Their average purchase price is significantly above current levels. This is either a brilliant long-term strategy or a case of throwing good money after bad. Time will tell.

Adding to the gloom, the Bitcoin Trend Indicator (BTI) has been flashing "Significant Downtrend" for 24 days as of November 2025. This isn't exactly a recipe for bullish sentiment.

Interestingly, altcoins, as measured by the CoinDesk 80 Index (CD80), have performed in line with or better than BTC post-October 10, 2025. This could indicate that investors are seeking higher-risk, higher-reward opportunities in the altcoin market, or simply that BTC had further to fall.

Investor sentiment, based on online chatter, seems to be a mix of shock and resignation. Many were caught off guard by the downturn and are attributing it to a variety of factors, from technical issues (ETF outflows, DATs < mNAV, 10/10 damage) to macro concerns (Fed rate cut probability decreasing, government shutdown damage, Clarity Act delay). Some are optimistic about a future rally, but even they acknowledge that 2025 might be a lost cause.

Chris Sullivan from Hyperion Decimus sees a "V-shaped event" ahead and is advocating to "feast on fear." (Easy to say when you're not the one holding the bag.) The development of put skew in Bitcoin is seen as a positive sign of market maturation. It suggests that investors are becoming more sophisticated in managing their risk.

I've looked at countless market analyses, and the recurring theme here is uncertainty masked as optimism. The data simply doesn't support the idea of a quick rebound.

Is "Safe Haven" Just a Marketing Ploy?

The rush to "safe haven" DeFi tokens feels more like a marketing narrative than a genuine flight to safety. Investors are clinging to perceived stability based on buyback programs and vague promises of "fundamental catalysts." But when you dig into the numbers, the underlying fundamentals of many of these projects are still shaky. The decline in DEX multiples and the steepening multiples in lending platforms tell a story of deteriorating performance and investor anxiety.

Crypto Long & Short: The Striking Dichotomy in DeFi Tokens Post 10/10 - CoinDesk

The broader market context, with ETF outflows and a bearish Bitcoin Trend Indicator, only adds to the uncertainty. El Salvador's Bitcoin gamble might pay off in the long run, but it's certainly not providing any short-term relief.

Don't Confuse Hope with a Strategy